What Does Hard Money Atlanta Do?

Wiki Article

Hard Money Atlanta - Questions

Table of ContentsSome Known Factual Statements About Hard Money Atlanta How Hard Money Atlanta can Save You Time, Stress, and Money.Hard Money Atlanta Can Be Fun For AnyoneHard Money Atlanta Things To Know Before You BuyAn Unbiased View of Hard Money Atlanta

These jobs are normally completed swiftly, thus the need for fast access to funds. Make money from the job can be utilized as a down repayment on the next, therefore, hard money car loans enable capitalists to scale and flip more homes per time - hard money atlanta. Given that the taking care of to resale time structure is short (normally much less than a year), residence fins do not need the long-lasting finances that traditional mortgage lenders use.This way, the project has the ability to accomplish completion within the set timeline. Standard lending institutions may be considered the reverse of difficult cash lenders. What is a difficult cash lender? Difficult money lending institutions are usually private companies or private investors that provide non-conforming, asset-based fundings primarily to investor.

Normally, these factors are not one of the most crucial factor to consider for car loan credentials (hard money atlanta). Instead, the worth of the residential property or property to be purchased, which would also be used as collateral, is largely thought about. Rate of interest might also differ based on the lender and the bargain in inquiry. Many lending institutions might charge rates of interest varying from 9% to even 12% or even more.

Hard money loan providers would certainly additionally bill a charge for giving the lending, as well as these costs are likewise referred to as "factors." They generally end up being anywhere from 1- 5% of the complete car loan amount, however, factors would normally amount to one portion factor of the lending. The significant distinction in between a hard money lender and other lending institutions hinges on the approval process.

The 25-Second Trick For Hard Money Atlanta

A tough money loan provider, on the various other hand, concentrates on the asset to be acquired as the top factor to consider. Credit rating, earnings, as well as other private demands come secondary. They also differ in regards to convenience of accessibility to funding and also rates of interest; tough cash loan providers give funding quickly as well as bill greater rates of interest also.You could find one in among the complying with means: A basic net search Request referrals from neighborhood genuine estate agents Request suggestions from genuine estate investors/ investor teams Given that the lendings are non-conforming, you must take your time examining the requirements and terms provided before making a computed and also informed decision.

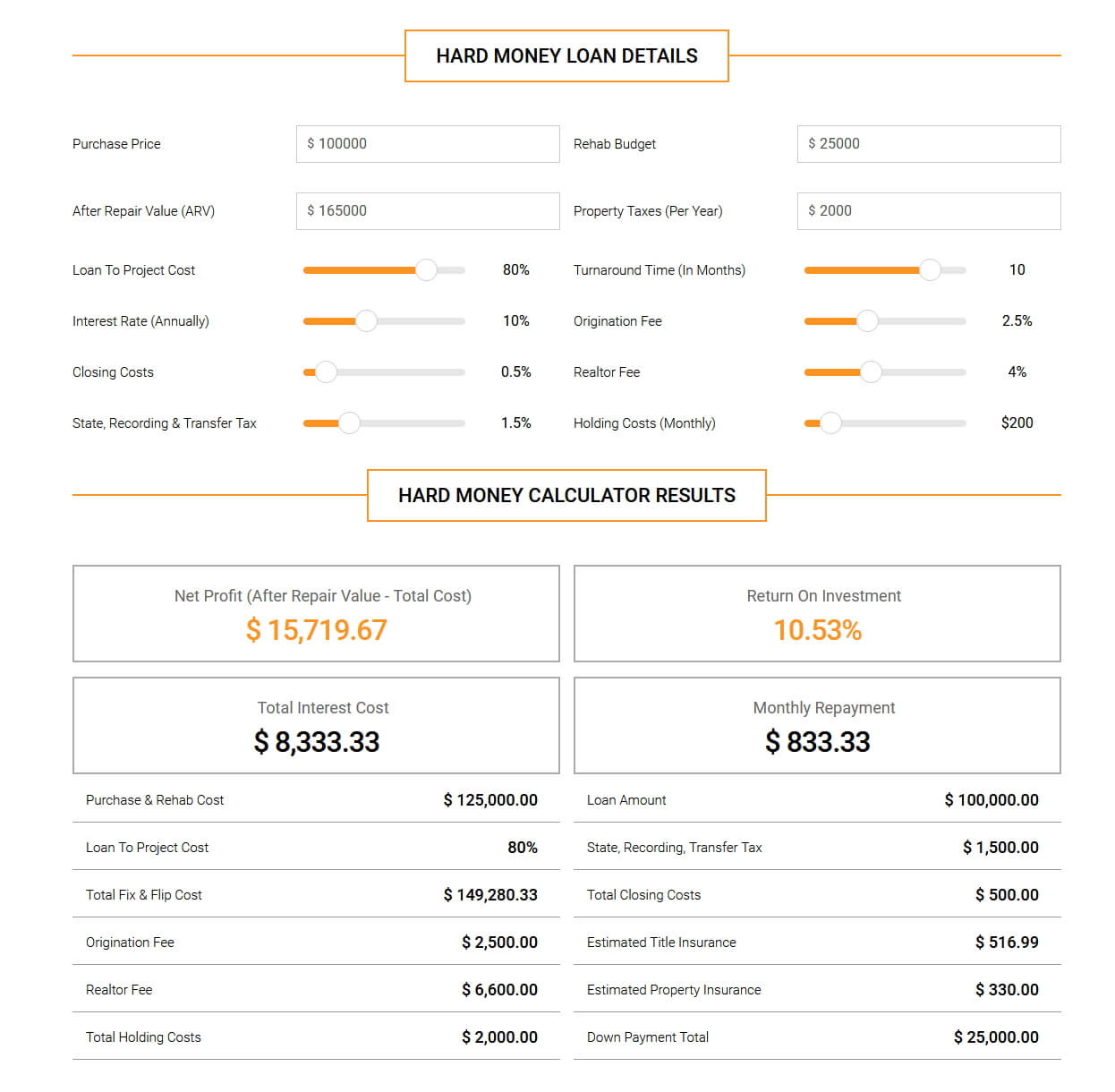

It is vital to run the numbers before selecting a tough cash lending to guarantee that you do not encounter any kind of loss. Make an application for your hard money car loan today as well as get a car loan commitment in 24 hr.

A tough cash financing is a collateral-backed financing, secured by the genuine estate being purchased. The dimension of the car loan is identified by the approximated value of the home after recommended fixings are made.

The Definitive Guide for Hard Money Atlanta

Many difficult cash lendings have a regard to 6 to twelve months, although in some instances, longer terms can be arranged. The consumer makes a month-to-month repayment to the lending institution, usually an interest-only repayment. Here's exactly how a regular tough money lending works: The debtor wishes to buy a fixer-upper for $100,000.

Some lending institutions find more info will certainly call for more money in the offer, and ask for a minimum down settlement of 10-20%. It can be beneficial for the investor to look for the lenders that call for very little deposit alternatives to reduce their money to close. There will certainly likewise be the common title charges connected with shutting a transaction.

Make certain to get in touch with the hard money lending institution to see if there are early repayment penalties billed or a minimal yield they require. Presuming you are in the finance for 3 months, and the residential property sells for the projected $180,000, the financier earns a profit of $25,000. If the home markets for greater than $180,000, the purchaser makes also more cash.

As a result of the shorter term and high rate of interest, there typically needs to be improvement and also upside equity to catch, whether its a flip or rental residential property. A hard money funding is ideal for a customer who desires to take care of as well as turn an underestimated residential property within a reasonably brief period of time.

Some Ideas on Hard Money Atlanta You Should Know

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

It is very important to know exactly how difficult cash fundings job and also exactly how they differ from conventional financings. Financial institutions and also various other standard banks stem most long-term finances and mortgages. These standard lending institutions do seldom handle tough cash financings. Instead, tough money finances are issued by personal financiers, funds or brokers that eventually source the offers from the exclusive financiers or funds.

The Facts About Hard Money Atlanta Revealed

When using for a difficult cash finance, borrowers require to confirm that they have sufficient capital to efficiently get via an offer. (ARV) of the building that is, the estimated value of the home after all renovations have been made.Report this wiki page